MeDirect Fixed-Term Account

Good things come to those who wait. If you’re willing to part with your money for a fixed period of time, you’ll reap the benefits. Payday is once a year, and you get to choose the currency.

The choice is yours |

|---|

From 3 months to 5 years, stay as long as you like. You have three currencies to choose from: euros, US dollars or pounds sterling. |

| Attractive rates |

|---|

| Reap the benefits at maturity for 3- and 6-month fixed-term deposit accounts, and annually for maturities ranging from 1 to 5 years. |

Risks |

|---|

| Bankruptcy risk, currency risk*, and inflation risk apply. See below for more details. |

It's free |

|---|

| There are no fees to pay. So you’re already saving money! |

*For deposits in GBP and USD.

Annual rates

|

|

EUR

|

GBP

|

USD

|

|||

|---|---|---|---|---|---|---|

|

TYPE

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

|

3 months

|

2.60%

|

1.82%

|

3.50%

|

2.45%

|

3.50%

|

2.45%

|

|

6 months

|

2.60%

|

1.82%

|

3.50%

|

2.45%

|

3.50%

|

2.45%

|

|

1 year

|

2.60%

|

1.82%

|

2.10%

|

1.05%

|

1.50%

|

1.05%

|

|

2 years

|

2.40%

|

1.68%

|

1.50%

|

1.05%

|

1.50%

|

1.05%

|

|

3 years

|

2.30%

|

1.61%

|

1.50%

|

1.05%

|

1.50%

|

1.05%

|

|

4 years

|

2.30%

|

1.61%

|

1.50%

|

1.05%

|

1.50%

|

1.05%

|

|

5 years

|

2.30%

|

1.61%

|

1.50%

|

1.05%

|

1.50%

|

1.05%

|

Pro-rata rates for maturities under 1 year

|

|

'Pro-rata’ rate EUR

|

'Pro-rata’ rate GBP

|

'Pro-rata’ rate USD

|

|||

|---|---|---|---|---|---|---|

|

TYPE

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

|

3 months

|

0.65%

|

0.46%

|

0.88%

|

0.61%

|

0.88%

|

0.61%

|

|

6 months

|

1.30%

|

0.91%

|

1.75%

|

1.23%

|

1.75%

|

1.23%

|

The rates offered on fixed-term deposit accounts are subject to change without notice and are applicable to a maximum amount of 100,000 EUR/USD/GPB per maturity. Please consult the fixed-term deposit account fact sheet.

*The rates for 3-month, 6-month and 1-year term accounts in euros are promotional rates; MeDirect reserves the right to change them at any time, including before 10 September 2024.

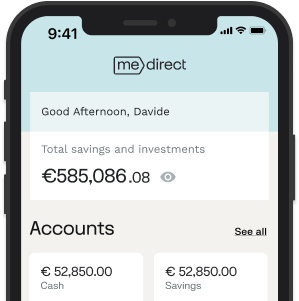

Online saving for planners

You set the term, we promise you a fixed rate for that entire period. Once your money has matured, we’ll set it free again for you to spend.

You choose your currency.

Whether you prefer euro, US dollars or pounds sterling, your minimum amount starts at €/£/$100.

Our interest rates may change. The exact current rates are always available on our website. Your account only exists online. Access it wherever you are.

This product has been created by MeDirect Bank S.A. (Belgian law applies).

Risks:

Bankruptcy risk:

If we ever go bankrupt, your savings will be guaranteed up to €100,000, which you will receive in cash. Any deposits you have over €100,000 may be reduced or converted into shares (bail-in).

Inflation risk:

Continuing price rises could lead to a loss in value of the saved money.

Currency risk:

The value in euros of your fixed-term deposit account in GBP or USD may be negatively affected by fluctuations in exchange rates.

Any complaints should first be directed to [email protected].

If you disagree with our proposed solution, you can contact the consumer mediation office for financial services (Ombudsfin), Boulevard du Roi Albert II 8, box 2, B-1000 Brussels. 02/545.77.70, ombudsman@

ombudsfin.be.

Please find our interest rates above.

Fiscality:

This tax regime applies to retail customers residing in Belgium.

The net interest rate is the rate after the deduction of 30% withholding tax.

Don’t worry, this tax will be deducted automatically.

Please also read our Fixed-Term Deposit Fact Sheet before opening an account, and note that there is no ‘Essential Information for Savers’ for this type of account.

Charges:

Fixed-term deposit accounts are free, but you will need to open a free current account.

Foreign currency conversion charges can be found in our Tariffs & Charges Guide.

Transfers can only be made when the account reaches maturity. Early withdrawals are not allowed.

Similar products

MeDirect

Dynamic Savings

A trip around the world or a bigger TV? Yes, you can! Here’s an account as spontaneous as your plans.

MeDirect

Essential Savings

Unexpected situations? This savings account yields right from the start and helps you deal with unpleasant surprises!

Still have questions?

How do I open an account ?

- Click ‘Become a client’ to start the online application process. You will be asked if you wish to open up a single or a joint account. Complete your personal data as requested on screen.

- You will be guided to provide a clear copy of the front and back of a valid Belgian ID and to take a selfie.You can choose from the following 2 options:

- Use your smartphone to take a photo of your ID and a selfie.

- Upload a photo or a scan of your ID and take a selfie using the camera on your electronic device (eg webcam).

- Complete the online application process and sign it digitally. Keep your mobile close at hand.

- Make a first payment to your MeDirect Cash Account from an external account registered in your name.

- If you applied to open a joint account, you can transfer your first payment from an external joint account (registered in the name of both account holders) or from two different accounts, each registered in the name of the individual account holder.

- Once the payment has been received, a MeDirect Cash Account will be opened for you. You will then get full access to the secure website.

How can I deposit funds in my account?

You can deposit funds by instructing a bank transfer from an external bank account to your MeDirect account.

Are there any fees for opening an account?

Helpful answers

Start saving

The sooner you start managing your money your way, the sooner you’ll see results. Make your own choices and find what feels good. Sign up and open your account in a heartbeat.